During the last few years, the transformation of the banking sector has been ascending, its objective focused on allowing people to perform various operations remotely and automatically is a priority. The concept of “Electronic Banking” is definitely here to stay, transforming business models around the world.

How much time did we previously spend standing in line to carry out a simple errand such as a consignment, pay utilities or catch up on credit? According to figures from VeriTran, a global digital banking solutions firm, users who prefer to make transactions physically waste about 4 hours a month at their bank’s facilities, which means 48 hours a year, not counting travel time. While today’s digital user, who prefers to use mobile or online banking, spends only 1 hour per month, enough time to perform at least 40 transactions of more than 1 minute each, from the comfort of his home.

The option of digitizing procedures is a necessity for banks today, because they know that meeting the financial demands of users by simplifying lengthy procedures means respecting their time, which is why it is considered an added value in their portfolio of services. Today they have customers with a greater financial culture, who demand speed in the provision of banking services, convenience and 24/7 availability.

When did banks realize that the epicenter of their business lies in optimizing users’ time?

It all goes back to early 1995 when Bill Gates, with his transformative and disruptive vision, declared through the world’s leading newspapers that banks and their databases were dinosaurs. According to his words, in the not too distant future, electronic banks would arrive with online operations, without branches, without high costs in the collection of services. Because the need for cash would be less and less, most purchases would be made through a PC wallet or smart cards with the same characteristics of plastic cards, checkbooks and ATMs.

This led analysts around the world to understand the importance of what was to come: a revolution in world banking, where the user would be the epicenter, without intermediaries and through a computer. And for this reason, before welcoming the year 1996, Wells Fargo & Co., today considered the fourth best bank in the U.S. and the third largest bank by market capitalization, began to offer its customers information on the status of their accounts on the Internet and Security First Network Bank (SFNB) was born, the first approved bank with online access, without physical branches, at first without much success in accessing its services due to people’s habit of visiting physical facilities and having one-on-one counseling with bank employees.

With the Internet boom, between the end of 1998 and mid-2000, the concept of Electronic Banking became widespread and more banks began to incorporate it into their operations. In 2007 the first cell phone, considered a smart phone, arrived and with its arrival, people expressed to banks the need for an agile service that would adapt to their mobile devices, in addition to having Internet banking, they wanted to have access at any time and from anywhere in the world.

Growth of users in electronic banking

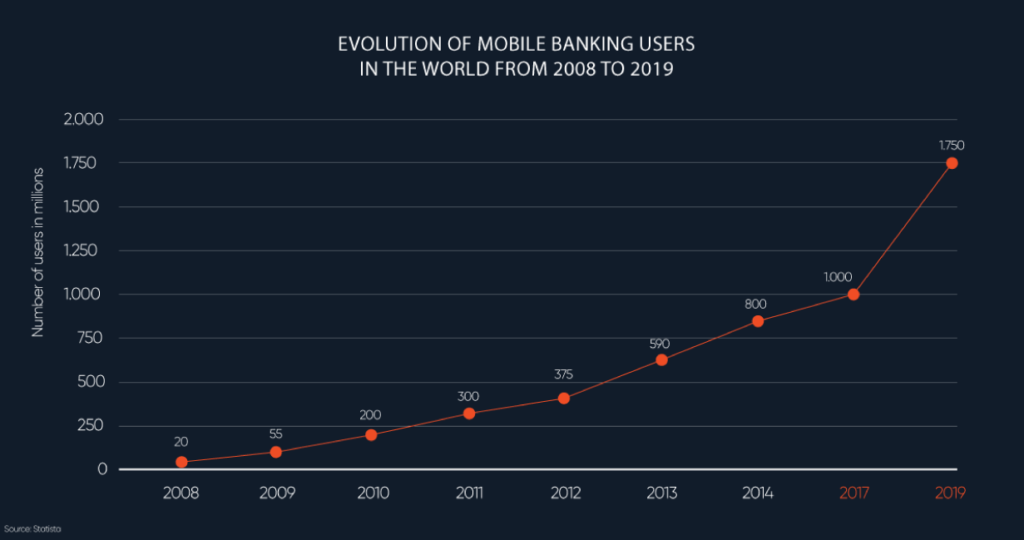

From this year the rest is history, from 2010 to today the growth of users in electronic banking is close to 65%, it is no secret that with the accelerated technological development in the financial world, new players have arrived and competition is increasing, which pressures traditional banks towards new evolutions forcing them to a real change in their organizational culture through technology.

Understanding the history and how this need arises, it is worth noting that after almost three decades as users of electronic banking, we have it fully integrated into our financial life, in a way it has given us independence by allowing us to perform operations in real time in an autonomous, secure and fast way, such as receiving bank statements immediately, making transfers in seconds, managing electronic payments, requesting loans or credits, buying and managing investments, among others.

Why is it important to master and apply the concept of Electronic Banking?

Just as banks have assumed the responsibility to evolve. Users should also do so in order not to be left behind. And for this it is necessary to keep in mind the advantages that the service offers:

- Convenience and 24-hour availability

- Global access

- Speed and time savings

- Cost savings for both the bank and the customer

- Increased transparency of information

- Personalized product and service offerings

Although there is a part of the population that still puts up resistance due to distrust in digital banking. It is undeniable that it has managed to completely transform the quality of life of those who make use of it. According to a report State of Mobile 2020, prepared by App Annie, an expert firm in app analytics, in 2019 access to finance-related applications was more than one billion times worldwide, the growth of users today is remarkable.

Investments of electronic banking

According to a study by Felaban, Latin American Federation of Banks, 48% of banks allocate between 10% and 20% of their budget to investments in technology and innovation. 17% invest more than 20% and only 5% allocate less than 5% of their budget to innovation. These are practices that should definitely be adopted by those who have not yet done so. Because investing in innovation means having a disruptive perspective that also gives them the possibility to:

- Expand beyond traditional operations: consumers are demanding a more humane treatment from brands. Implementing a plan to place the customer at the center of the business means for banks to be at the forefront of their needs. To achieve a closer treatment and strengthen the relationship to consolidate it in the long term.

- Obtain great benefits from Artificial Intelligence: although making each customer feel special is complicated, there are tools that generate closeness such as virtual assistants. That, when correctly implemented, can achieve a positive user experience.

- Monitoring the omnichannel strategy: users value more having access to digital channels that favor time savings in their procedures. They want agile services. They seek access to multiple service channels that are effective and guarantee a satisfactory experience.

- New monetization strategies: paying to withdraw money or make a transfer is a thing of the past. The most important revenue stream for banks is the monetization of customer data. Identifying patterns in the data gives the possibility to act accordingly to avoid financial losses.

- Building trust: this is the basis on which the banking industry moves. It is vital to focus on strategies that recover and accelerate the process of closeness with users. Such as quality improvement, confidentiality guarantees, service optimization and information transparency.

To conclude

It is a fact that banks are evolving from being institutions focused on the physical structure to being digital. Offering them experiences with a more transparent, economic and flexible set of banking services.

At Interfaz we have worked with the banking sector since 2004. Supporting its positioning through the implementation of cutting-edge technologies. Under strict security and quality standards. Several renowned banks in Costa Rica have relied on our services in Digital Transformation for the fulfillment of their objectives.

Sources: